New Study Finds Severe Weather Now Influences Homeowners’ Insurance Prices

Insurance prices spike with severe weather forecasts and plummet after storm season ends—shopping in early spring could save homeowners thousands.

HOUSTON, TX, UNITED STATES, January 21, 2026 /EINPresswire.com/ -- Timing Your Policy Purchase Could Save Hundreds Each YearA new nationwide study reveals that when you shop for homeowners' insurance could now be almost as important as where you live. Researchers at UtilityRates.com reviewed data from online insurance quote services across all 50 states and found that premiums rise and fall throughout the year in step with severe weather forecasts and storm activity. As a result, bad timing could end up costing homeowners hundreds or even thousands of dollars.

You can find the full "When Is the Best Time to Shop for Homeowners' Insurance?" study here: https://www.utilityrates.com/resources/best-time-to-shop-for-homeowners-insurance

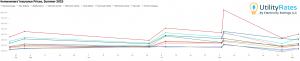

From April through September 2025, researchers analyzed pricing data to insure an average $300,000 home from eight major insurance quote services and discovered that rates often surged in step with weather forecasts and storms. Prices peaked during hurricane and storm seasons, then fell once threats passed - sometimes by thousands of dollars. Specifically, the findings show that prices tend to spike during months when hurricanes, tornadoes, or severe storms are forecast and then drop once weather risks decline.

Key Findings:

1. Online insurance quote services show that average premium prices can spike when weather risks are thought to be highest. Prices in the most risky regions can triple during the height of the hurricane season threat and then plummet at the end.

2. Sudden price spikes in high risk states can reverberate across the whole market as insurers try to cover potential losses. Regions with lower bad weather risks can see their average annual premium prices jump by $500 to over $1,000 in response.

3. Large price swings appear to rise and fall in concert with severe weather forecasts and storm activity and may now exert stronger pressure on home insurance rates.

4. Consumers need to be more weather-aware about the cost of protecting their homes. The study suggests that they should also consider the time of year when shopping for the lowest home insurance policy rate. Settling on a new policy by mid-April before hurricane predictions are announced may help find a low annual premium and likewise help with subsequent renewals.

Weather's Growing Financial Impact

Increasingly severe weather continues to take a massive financial toll all across the country. From Pennsylvania energy rates affected by storm-related grid repairs to natural gas prices in Georgia impacted by severe weather disruptions, to Texas electricity companies managing storm recovery costs. For new families, especially those arriving in southern states, high utility rates, home prices, and mortgage rates are already making the dream of owning a home difficult. High home insurance costs make it all but impossible. Just as consumers benefit from an apples to apples comparison when choosing energy providers, the same careful evaluation approach is now essential for homeowners insurance shopping

In the first six months of 2025 alone, severe convective storms-including tornadoes, hail, and high winds-caused $31 billion in U.S. property losses. According to reinsurer Swiss RE, roughly 70% of these losses occur before July, just as insurers begin bracing for hurricane season. Such widespread events can push insurers to adjust rates quickly.

Hurricane Season Price Surges

In the case of tropical storms and hurricanes, prices can rise based on weather forecasts, even before storms hit. During this past summer, Florida's average annual rate spiked to $15,460, while Louisiana's climbed to $13,937, roughly triple their early spring averages. The price surge began as Tropical Storm Dexter stirred fears of an active hurricane year. Even states far from coastal danger zones weren't immune with average premiums jumping $500 to $1,000 as insurers spread their financial risk nationwide.

Key Takeaway: Shop Smart, Shop Early

Insurers are now reacting faster to risk because their losses from severe weather can put them out of business. With states experiencing more powerful storms, the research suggests homeowners should be as strategic about when they shop as they are about what coverage they buy. Homeowners may benefit by shopping for insurance between January and April, before major hurricane forecasts are announced. During this period, insurers may have fewer reasons to raise rates, making premiums more stable. Locking in a policy before the summer storm season heats up could help consumers avoid price spikes and save hundreds annually.

About UtilityRates.com

UtilityRates.com is operated by Electricity Ratings, LLC.

Electricity Ratings, LLC operates a network of energy shopping websites serving 17 states and 56 utilities, providing our energy comparison and ratings service to over 80 million customers. We provide our customers with the power to choose the best providers through our consumer reviews platform which provides a reliable, unbiased source of valuable consumer insight. And we back that up by offering in-depth energy company service analysis, personalized recommendations, and practical advice. Our mission is to help consumers harness the power of information to find, compare, and buy electricity and energy services from the best providers.

###

Contact

https://www.utilityrates.com/

Vernon Trollinger

UtilityRates.com

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.